Cryptocurrency Industry | Exploring the Diverse Landscape

Global cryptocurrency industry data book is a collection of market sizing information & forecasts, regulatory data, reimbursement structure, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research.

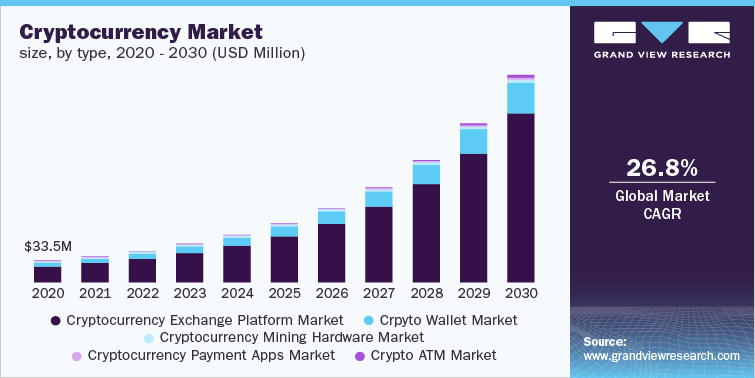

The global cryptocurrency market generated over USD 40.09 billion in 2021 and is expected to grow at a CAGR of 26.8% over the forecast period.

Cryptocurrency Mining Hardware Market Growth & Trends

The cryptocurrency mining hardware market was valued at USD 2.32 billion in 2021 and is expected to reach USD 5.03 billion by 2030 at a CAGR of 9.3% from 2022 to 2030. The growth of the market is anticipated to several companies across the globe are also focusing on collaborative initiatives for the development of advanced mining solutions to provide a better customer experience. For instance, in March 2021, DMG Blockchain Solutions Inc. announced its collaboration with Argo Blockchain to launch the Terra Pool, an integrated Bitcoin mining pool powered by sustainable energy. This launch helped DMG Blockchain Solutions Inc. to shift its customer interest towards sustainable technology solutions and differentiate its offering in the market.

This market is segmented based on type, coin, and application. Based on type it is divided into Central Processing Unit, Graphics Processing Unit, Application-Specific, Integrated Circuit, and Field Programmable Gate Array. The application-specific integrated circuit held a highest share in 2021 and are anticipated to grow at the significant CAGR over the forecast period. An Application-Specific Integrated Circuit (ASIC) is an electronic circuit designed for the sole purpose of mining cryptocurrencies. It is designed to mine cryptocurrencies such as Bitcoin, Litecoin, Ethereum, Zcash, and a few other crypto assets.

Cryptocurrency Exchange Platform Market Growth & Trends

The global cryptocurrency exchange platform market was valued at USD 30.18 billion in 2021 and is anticipated to witness growth at a rate of 27.8% over the forecast period. The rise of cryptocurrency as a decentralized asset class has attracted investments by private venture companies in the market. For instance, the U.S. market witnessed investments worth USD 6.1 billion in 2021 across 106 deals. The growth is further supported by the increased demand for cryptocurrency as an alternative form of tender across emerging economies, such as Argentina, Zimbabwe, and Iran, plagued with devalued currencies.

This market is segmented based on cryptocurrency type, and end use. Based on cryptocurrency type it is divided into Bitcoin, Ethereum, Cardano, Solana, and Others. The Ethereum held a significant share in 2021 and are anticipated to grow at the second-fastest growth rate over the forecast period. Ethereum’s popularity is growing in parallel with the emergence of digital assets, such as NFTs and Decentralized Finance (DeFi) projects. Furthermore, the growth of the Ethereum market can be attributed to the significant increase in traffic on the Ethereum network owing to the influx of new projects running on it. Ethereum was the first cryptocurrency to utilize smart contracts for algorithm-based financial transactions.

Crypto Wallet Market Growth & Trends

The global crypto wallet market was valued to be USD 6.97 billion in 2021 and is anticipated to witness growth at a rate of 24.4% over the forecast period. The robust security provided by the crypto wallets is expected to impel the demand for crypto wallets, thereby driving the future market growth. Furthermore, crypto wallets allow sending, receiving, and spending of cryptocurrencies such as Ethereum and Bitcoin.

The global crypto wallet market is segmented based on wallet type, operating system, application, and end-user. Based on crypto wallet type it is divided into hot wallets and cold wallets. The hot wallets segment dominated the market in 2021 owing to ease in accessing hot wallets as it can be downloaded on desktops, smartphones, or other devices. Cold wallets segment is expected to register significant growth during the forecast period. The high security offered by cold wallets owing to no link with the internet is expected to drive the segments growth. Cold wallets are considered a safer or more secure option for storing cryptocurrency.

Order your copy of Free Sample of “Cryptocurrency Industry Data Book - Cryptocurrency Mining Hardware & Exchange Platform, Crypto Wallet, Cryptocurrency Payment Apps and Crypto ATM Market Size, Share, Trends Analysis, And Segment Forecasts, 2022 - 2030” Data Book, published by Grand View Research

Cryptocurrency Payment Apps Market Growth & Trends

The global cryptocurrency payment apps market size was valued at USD 545.4 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 16.6% from 2022 to 2030. The approval and legalization of the purchase, sale, and trade of cryptocurrencies in various developed countries has contributed to the growth of the market. Additionally, the legalization of cryptocurrency has sparked interest among digital payment application providers, resulting in the launch of new applications that support cryptocurrency payment methods. The market is segmented into cryptocurrency type, payment type, operating system, and end user.

Based on cryptocurrency type, the market is segmented into Bitcoin, Ethereum, Litecoin, DAI, Ripple, and Others. The Bitcoin segment dominated the market in 2021. The dominance is attributable to bitcoin being the pioneer of the industry. Furthermore, the dominance can be attribute to several large enterprises, including Microsoft and Whole Foods, that accept bitcoin to make the purchases. However, the Ethereum segment is expected to grow at the significant rate during the forecast period. Several businesses, including Overstock, Shopify, and Gipsybee, among others, accept payment in Ethereum. For instance, egifter, allows its users to purchase gifts of more than 300 brands using Ethereum. Moreover, the rise in the decentralized finance (Defi) and NFT market is also expected to drive the Ethereum market over the forecast period.

Crypto ATM Market Analysis & Forecast

The global crypto ATM market size was valued at USD 75.0 million in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 61.7% from 2022 to 2030. The growth of the market can be attributed to the growing demand for crypto ATMs from cryptocurrency users worldwide. Cryptocurrency users are preferring crypto ATMs because they offer easier trading options, do not involve any online wallets, and do not require setting up an account and dealing with lengthy public keys. The growing number of startups focusing on providing cryptocurrencies and the growing use of cryptocurrencies, particularly among youngsters, are also emerging as some of the major factors opening new opportunities for the growth of the market.

The crypto ATM market is segmented into type, offering, coin type, and application. The type segment is further divided into one way and two way crypto ATMs. The one-way segment dominated the market in 2021. One-way crypto ATMs enable the users to convert cash to cryptocurrency. It offers various benefits to the users, such as remote monitoring and management, remote software up-gradation, and others, which is expected to drive the growth of the segment. However, the two-way segment is anticipated to witness the fastest growth over the forecast period. The increasing installation of bidirectional two-way ATMs in malls is expected to drive the growth of the segment. For instance, in August 2021, BR Malls, a mall chain in Brazil, announced its partnership with Coin Cloud, a manufacturer of bitcoin ATMs to install 15 ATMs in four Brazilian cities. The ATMs provided by Coin Cloud are bidirectional, which enables the customers to buy and sell cryptocurrencies.

Key players operating in the Cryptocurrency Industry are –

• BlockFi International Ltd

• Coinmama

• eToro

• Coinbase

• Binance

• Canaan Inc.

• INTELION

• ASICminer Company

• INNOSILICON Technology Ltd

• Binance

• BitPay

• SatoshiLabs s.r.o.

• Elvie

• BitGo

• BlockFi Inc.

Comments

Post a Comment