Advanced Payment Cards Industry: Decoding The Secret World Of Secure Transactions

Global advanced payment cards sector database is a collection of market sizing information & forecasts, regulatory data, reimbursement structure, competitive benchmarking analyses, macro-environmental analyses, and regulatory & technological framework studies. Within the purview of the database, all such information is systematically analyzed and provided in the form of presentations and detailed outlook reports on individual areas of research.

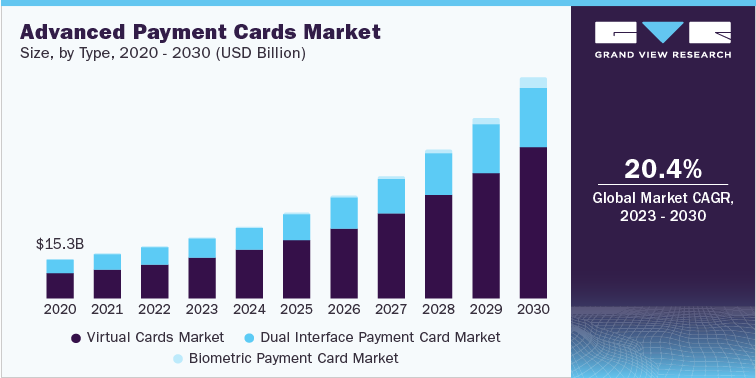

The global Advanced Payment Cards Market size for advanced payment cards was estimated at USD 20.50 billion in 2022 and is anticipated to increase at a CAGR of 20.4% from 2023 to 2030.

Virtual Cards Market Report Highlights

The virtual cards market was estimated at USD 13.31 billion in 2022 and is anticipated to grow at a CAGR of 20.9% from 2023 to 2030. The market is projected to reach USD 60.06 billion by 2030. The growth can be attributed to the rising adoption of virtual cards by businesses for B2B payments. Furthermore, the rising investments by venture capital firms in virtual card providers is another major factor driving the market’s growth. For instance, in October 2021, Extend Enterprises, Inc., a digital card platform provider, announced that through a Series B funding round, it raised USD 40 million. The round was led by March Capital, along with participation from investors, including Fintech Collective, B Capital, Reciprocal Ventures, Point72 Ventures, Pacific Western Bank, and Wells Fargo. The company aimed to utilize these funds to offer virtual cards to assist banks in competing with other FinTechs.

The virtual cards market is segmented based on card type, product type, and application. Based on card type, it is divided into debit card and credit card. The credit card segment held the highest share in 2022 and is anticipated to grow at the fastest CAGR of 21.6% over the forecast period. The growth of the credit card segment can be attributed to the increasing use of virtual credit cards by businesses and consumers for processing secure and contactless virtual payments. These cards generate random 16-digit numbers with expiry dates and CVV codes for each transaction. Payments made through virtual credit cards are routed back to the existing credit card using a current line of credit. Some of these virtual credit cards allow users to earn points on each purchase made, which users can use for benefits such as travel and employee incentives.

Dual Interface Payment Card Market Report Highlights

The global dual interface payment card market size is expected to reach USD 23.66 billion by 2030, growing at a CAGR of 16.2% from 2022 to 2030, according to a new study conducted by Grand View Research, Inc. In 2022, the global dual interface payment card market was valued at USD 7.10 billion and is anticipated to witness a CAGR of 16.7% over the forecast period. The market is anticipated to grow due to the factors such as the rising adoption of contactless payments by consumers. For instance, according to the Mastercard Contactless Consumer Polling, nearly 51% of Americans use contactless payment, including tap-to-go credit cards and mobile wallets. Furthermore, the high acceptance of dual interface payment cards across various platforms owing to their ability to process payments in both contactless and contact modes also bodes well for the growth of the market.

The dual interface payment card market is segmented based on type and end-use. Based on type, it is divided into plastic and metal. The plastic segment held the maximum share in 2022 and is anticipated to grow significantly over the forecast period. Plastic cards enable issuing banks to offer their customers unique designs and create a brand identity through these designs. These cards come with customized prints, fonts, shines, and engraved letters, enabling banks to make their brand name and logo more prominent. Furthermore, dual interface payment cards are usually made of plastic owing to the cost-effectiveness and durability of the material, thereby anticipated to drive the segment’s growth over the forecast period.

North America dominated the global dual interface payment card market in 2022 and accounted for the maximum overall revenue share. The region's dominance is attributed to the rapid adoption of technology in the region. Consumers in the region have proven to be quick at adopting and implementing new technologies in their daily lives. Dual interface payment cards use technologies such as Near Field Communication (NFC) and Radio Frequency Identification (RFID) to make contactless payments within a few seconds. However, the Asia Pacific region is expected to register the highest CAGR over the forecast period. Several merchants across Asia Pacific have started accepting contactless payments based on the latest technologies, including NFC technology and QR code technology. The continued digitalization of banks and other financial institutions is also paving the way for the growth of the Asia Pacific dual interface payment card market.

Order your copy of Free Sample of “Advanced Payment Cards Industry Data Book - Virtual Cards, Dual Interface Payment Card and Biometric Payment Cards Market Size, Share, Trends Analysis, And Segment Forecasts, 2023 - 2030” Data Book, published by Grand View Research

Biometric Payment Cards Market Report Highlights

The global biometric payment cards market size was valued at USD 0.09 billion in 2022. It is projected to grow at a CAGR of 68.3% over the forecast period from 2023 to 2030. The growth can be attributed to the growing demand for biometric security. The rising fraud instances and cyberattacks have led to high consumer demand for biometric verification. For instance, in July 2021, according to a study by Fingerprint Cards, around 62% of consumers could switch banks to get a biometric card. Furthermore, the biometric payment card offers customers a quick and convenient payment authentication process without remembering the passcodes for processing transactions, which is anticipated to fuel the market's growth.

The global biometric payment cards market is segmented based on type and end-use. Based on type, it is divided into credit cards and debit cards. In 2022, the debit cards type segment dominated the market since numerous identity technology companies across the globe are partnering with fintech companies to enhance security for contactless payments made through debit cards. For instance, in December 2020, IDEMIA, a global identity company, and Rocker, a Swedish fintech company, announced their partnership to enhance the security of contactless payments by offering IDEMIA's F.CODE biometric payment card. The debit card utilizes biometric technology, which stores all the biometric credentials on the chip of the card.

North America dominated the biometric payment cards market in 2022. North America houses several key players in the market, including IDEX Biometrics ASA; Mastercard; and Visa Inc. Additionally, the region is known for being an early adopter of the technology. The Asia Pacific region is anticipated to emerge as the fastest-growing region over the forecast period. With the rising urban population and increasing purchasing power, the Asia Pacific region is expected to be one of the fastest-growing markets over the forecast period. The growth can be attributed to the initiatives pursued by various governments in the region to promote digitization and encourage the adoption of contactless payment technologies.

Competitive Landscape

Key players operating in the Advanced Payment Cards Industry are –

• American Express Company

• JPMorgan Chase & Co.

• Mastercard

• Marqeta, Inc

• Skrill USA, Inc.

• Stripe, Inc.

• Adyen

• Wise Payments Limited

• Valid Solucoes S.A.

• Giesecke+Devrient GmbH

• Eastcompeace Technology Co., Ltd

• Wuhan Tianyu Information Industry Co., Ltd

• BTRS Holdings, Inc.

• WEX, Inc

• Thales Group

• IDEMIA

• Zwipe

• CPI Card Group Inc

• Paragon Group Limited

• bio-idz

• IDEX Biometrics ASA

• BNP Paribas

• Goldpac Fintech

• Infineon Technologies AG

• NXP Semiconductors

• Visa Inc

• Watchdata Co., Ltd

Comments

Post a Comment